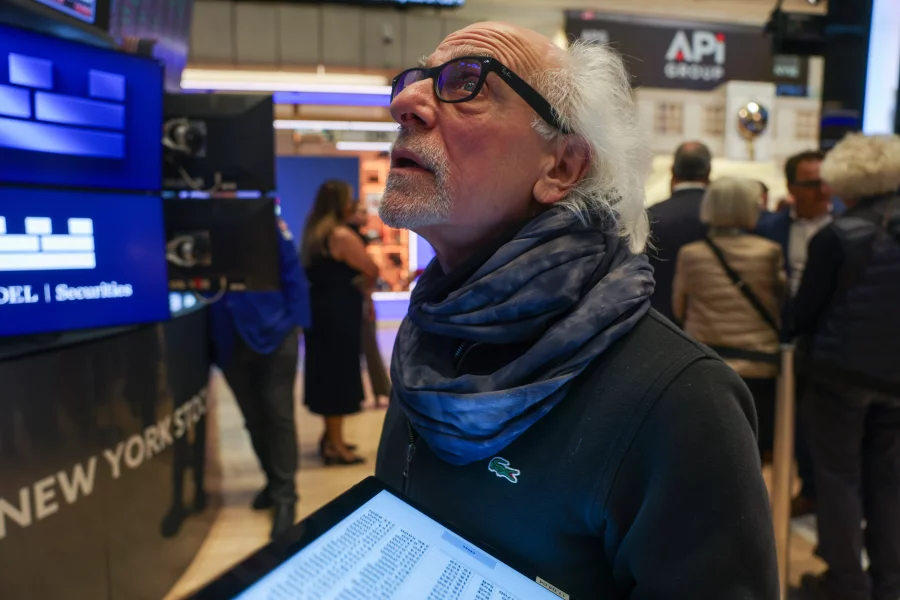

Wall Street is experiencing another period of significant volatility. A concerning trend, known as “Sell America,” is gaining momentum among investors. This strategy involves offloading U.S. government bonds. The primary driver behind this shift is a deepening concern over the worsening national deficit. This financial challenge is negatively impacting investors’ outlook on the United States and its standing in the global economy.

Rising Borrowing Costs: A Warning Sign

The U.S. government is facing increased costs to finance its debt, signaling growing investor apprehension.

Tepid Demand for U.S. Bonds

On a recent Wednesday, the U.S. Treasury department conducted an auction for $20 billion worth of bonds. The demand for these bonds was notably tepid. This weak interest forced the Treasury to pay a slightly higher interest rate, or yield, than initially anticipated. This indicates that investors are becoming more cautious about holding U.S. debt.

Spiking 30-Year Treasury Yields

This lukewarm demand has spooked financial markets. Yields on 30-year U.S. Treasuries have recently surged above 5%. This is an unusual and unsettling increase in the cost of long-term borrowing for the U.S. government. A rise in bond yields has a significant and detrimental impact on the broader economy. It directly jacks up interest rates on various consumer loans. This includes crucial financial products like mortgages and other forms of credit. This means higher costs for American consumers.

Foundations of the Global Financial System Questioned

U.S. Treasury bonds have historically been considered among the safest and most stable investments globally. They form the very underpinning of the global financial system. However, the current “Sell America” trend suggests a profound shift. Investors are now questioning the country’s economic supremacy.

They are also expressing doubts about its long-held creditworthiness. This unprecedented level of scrutiny represents a significant challenge to the dollar’s status as the world’s reserve currency and U.S. assets as the ultimate safe haven.

External Warnings and Downgrades: Fueling Investor Fears

International financial bodies and ratings agencies are adding to the pressure, issuing warnings about U.S. fiscal policy.

European Central Bank’s Tariff Alert

This week, the European Central Bank (ECB) issued a stern warning. The ECB cautioned that President Trump’s sweeping tariffs pose a significant risk to the global financial system.

The central bank’s statement on Wednesday highlighted the potential for severe disruptions. “Frequent shifts and reversals in tariff policy, alongside significant changes in the geopolitical environment, could have major economic and financial impacts,” the ECB stated. This warning underscores how U.S. trade policies are perceived as a source of instability on the international stage.

Moody’s Creditworthiness Downgrade

The ECB’s warning closely followed a critical action by Moody’s, a leading credit rating agency. Just days prior, Moody’s downgraded the creditworthiness of the United States. The primary reason cited for this downgrade was the rapidly mounting U.S. national deficit. This deficit is quickly approaching a staggering $2 trillion. This downgrade sends a strong signal to global investors. It indicates that the agency perceives an increased risk in lending to the U.S. government.

Implicit Criticism of Budget and Tax Cuts

Moody’s warning also contained an implicit criticism of President Trump’s budget bill and its associated tax cuts. The rating agency highlighted a key concern: extending these tax cuts will significantly reduce the U.S. government’s ability to generate more revenue. This, in turn, will inevitably worsen the current national deficit.

Moody’s stated, “We do not believe that material multi-year reductions in mandatory spending and deficits will result from current fiscal proposals under consideration.” This indicates a lack of confidence in current fiscal plans to address the growing debt burden.

Shifting Perceptions: The End of “U.S. Economic Exceptionalism”?

The confluence of these factors is profoundly impacting how investors, businesses, and consumers view the United States.

A New Narrative Emerges

The “Sell America” trade signifies a “whole change in narrative around U.S. economic exceptionalism,” according to Winnie Cisar. Cisar, who serves as the global head of strategy at CreditSights, emphasizes this shift. For decades, the U.S. economy was often seen as uniquely resilient and superior. This perception is now being challenged.

Increased Perceived Risk

Cisar further elaborates on the evolving investor sentiment. She notes that investors now share “a general perception that the U.S. is perhaps a riskier place to park your cash than it was six months ago.”

This increased perception of risk is a direct result of the escalating national deficit, ongoing economic uncertainty from tariff policies, and the resulting credit downgrades. This change in sentiment could have far-reaching implications for capital flows, investment decisions, and the U.S. economy’s standing in the world. Businesses may reconsider investment, and consumers could face tighter credit conditions.