Uber Technologies (UBER) released its first-quarter 2025 earnings results on Wednesday, presenting a mixed financial picture that saw the company beat analyst expectations for earnings per share but fall slightly short of revenue forecasts for the quarter. Following the report, Uber stock declined by about 5% in early trading.

Understanding Uber’s Business Model

Uber operates a global technology platform that primarily facilitates connections between consumers and independent service providers. Its core operations are divided into two main segments: Mobility, which encompasses its traditional ride-hailing services, and Delivery, which includes its Uber Eats food and grocery delivery services. This dual focus allows Uber to capture a significant portion of the on-demand transportation and delivery markets worldwide.

Q1 2025 Financial Snapshot

For the first quarter of 2025, Uber reported revenue of $11.53 billion. While this represented a solid 14% increase from the $10.13 billion recorded in the same period of 2024, it narrowly missed the average analyst expectation of $11.62 billion, according to data compiled by LSEG. However, the company delivered a strong performance on the bottom line, reporting a net income of approximately $1.78 billion, translating to 83 cents per share.

This marked a significant swing from a net loss of $654 million, or 32 cents per share, in the first quarter of the previous year, demonstrating notable progress towards profitability.

Robust Growth in Core Platform Metrics

Despite the slight miss on the revenue forecast, Uber’s operational metrics painted a picture of robust underlying growth and user engagement. The company’s largest business segments, Mobility and Delivery, both saw strong year-over-year increases in gross bookings. Mobility gross bookings rose by 13% to $21.18 billion, while Delivery gross bookings increased by 15% to $20.38 billion.

Furthermore, Uber’s platform continued to expand its reach, with monthly active platform consumers growing to 170 million, up 14% from the first quarter of last year. User activity also surged, with consumers booking around 3.04 billion “trips” during the first quarter of 2025, an impressive 18% increase compared to the first quarter of 2024. These figures highlight continued strong demand and utilization of the Uber platform globally.

Navigating Regulatory Scrutiny: The FTC Lawsuit

Uber is currently navigating regulatory challenges, including a lawsuit filed by the Federal Trade Commission (FTC) in April. The FTC’s suit accuses Uber of “deceptive billing and cancellation practices” related to its subscription service, Uber One. Uber One is an increasingly important part of Uber’s business model, offering benefits like discounts and waived delivery fees to members, which helps drive user loyalty and recurring revenue.

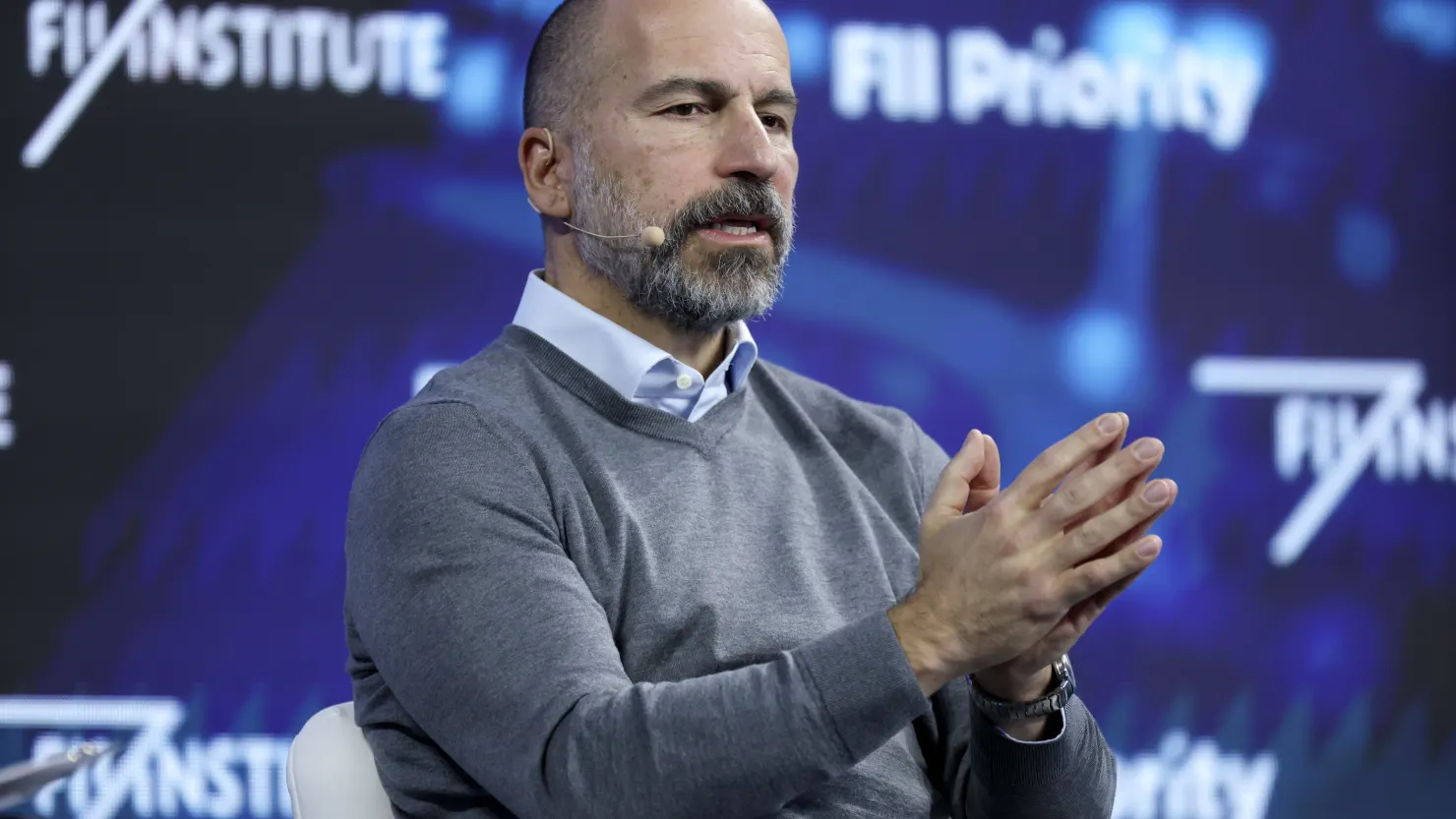

CEO Dara Khosrowshahi addressed the lawsuit, calling it “a bit of a head-scratcher” and defending the Uber One subscription service. He noted that 60% of the company’s gross bookings in the Uber Eats business come from Uber One members and emphasized that the service is growing quickly. Regarding the cancellation process, Khosrowshahi defended it as “very, very simple,” stating it requires just “a couple of steps to be able to cancel if you want.”

Internal Policy Adjustments

In addition to external factors, Uber has also been implementing internal policy changes that have drawn attention. At the end of April, the company informed employees that they would be required to return to the office three days a week, an increase from the previous two-day requirement, with the mandate also applying to some remote staff. Uber also announced changes to its monthlong paid sabbatical benefit, raising the eligibility requirement from five years of tenure at the company to eight years.

CEO Khosrowshahi defended the return-to-office policy changes at a reportedly “heated all-hands” meeting, telling CNBC that to be at the “top of our game,” the company needs “people working together in the office.” These adjustments signal internal shifts as the company matures and refines its operational structure.

Strategic Focus: The Autonomous Vehicle Push

Looking towards future growth, Uber is making a significant strategic push into autonomous vehicles (AV) technology. CEO Khosrowshahi stated that the company views AVs as “the single greatest opportunity ahead for Uber.” The integration of AVs holds the potential to dramatically change the economics of ride-hailing and delivery by potentially reducing the cost per trip and increasing efficiency in certain operational areas by removing the reliance on human drivers.

Uber is exploring various applications for AVs on its platform, allowing app users to book robotaxi rides in some U.S. markets and order food for delivery via autonomous vehicles in others. The company recently stated it has reached an “annual run-rate” of 1.5 million autonomous vehicle trips on its platform.

AV Strategy: Partnerships Drive Deployment

Uber’s approach to deploying autonomous vehicles is largely driven by partnerships with specialized AV technology companies rather than exclusively developing the technology in-house. The company has forged agreements with a range of partners for different services. For instance, Uber has partnered with Alphabet-owned Waymo to offer robotaxi hailing in select markets.

It also has partnerships with Volkswagen, Avride, May Mobility, and the autonomous trucking company Aurora for future autonomous vehicle ride-hailing and freight services in the U.S. Internationally, Uber has additional AV partnerships with companies including WeRide, Pony.AI, and Momenta. This partnership strategy allows Uber to integrate cutting-edge AV technology onto its platform without bearing the full burden and cost of developing the self-driving technology itself.

Early Successes in AV Deployment

Early results from Uber’s AV partnerships appear promising. In March, the company began offering users in Austin, Texas, the option to exclusively hail a Waymo robotaxi directly through the Uber app. Khosrowshahi reported that the Waymo Austin launch “exceeded” Uber’s expectations and highlighted the efficiency of the AV fleet, stating that around 100 Waymo vehicles operating in Austin are now “busier than over 99% of all drivers” in Austin in terms of completed trips per day.

This data point provides concrete evidence of the potential for high utilization and efficiency gains as Uber integrates autonomous vehicles more broadly onto its platform.

Q2 Outlook

Looking ahead, Uber provided guidance for the second quarter of 2025, signaling its expectations for the current period’s performance. The company forecasts gross bookings to reach between $45.75 billion and $47.25 billion during the second quarter. For adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA), Uber expects a range of $2.02 billion to $2.12 billion for the same period.

This guidance provides investors with the company’s near-term financial outlook, presumably reflecting their expectations for continued growth in core ride-hailing and delivery segments, as well as ongoing progress in strategic areas like the deployment of autonomous vehicles.

Building Towards the Future

Uber’s first-quarter 2025 earnings report delivered a mixed financial headline with a revenue miss despite beating earnings per share and swinging to a significant net income. However, the report also underscored the underlying strength of Uber’s core platform through robust growth in gross bookings, user engagement, and total trips.

While navigating current challenges such as the FTC lawsuit and implementing internal policy adjustments, Uber is clearly focused on building towards the future, particularly through its significant strategic investments and partnerships in autonomous vehicles. The early successes seen in AV deployment, coupled with a positive outlook for the current quarter, indicate that Uber is working to capitalize on major future opportunities as it continues to evolve its global ride-hailing and delivery platform.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Consult with a qualified financial 1 professional before making investment decisions.