A significant development in the European mining sector has just unfolded, marking a potential shift in the global diamond industry. Authorities in Finland have officially granted crucial mining rights to Karelian Diamond Resources, an Ireland-based company.

This landmark approval brings the company a monumental step closer to operating what is poised to become the first diamond mine within the European Union, excluding Russia. This development holds considerable economic and strategic implications, potentially diversifying the source of precious gems for the European market and beyond. The news has been met with keen interest from investors, environmental groups, and the broader mining community, highlighting Finland’s emerging role in the extraction of valuable minerals.

The Lahtojoki Deposit: A Gemstone Treasure Trove

At the heart of this groundbreaking venture lies the Lahtojoki deposit, a geologically significant site that has long been identified for its potential.

Geographical and Geological Significance

The Lahtojoki deposit is situated within a 71-hectare concession area. This expansive tract of land in the Kuopio-Kaavi region of Finland has been under meticulous exploration for years. The most critical feature within this concession is a 16-hectare kimberlite pipe. Kimberlite pipes are ancient, carrot-shaped volcanic rock formations that are the primary source of diamonds on Earth.

They are essentially conduits through which diamonds, formed deep within the Earth’s mantle, are brought to the surface during volcanic eruptions. The presence of a kimberlite pipe of this size at Lahtojoki indicates a substantial and potentially viable diamond resource. Geologists have spent extensive time studying the unique characteristics of this particular pipe, confirming its potential to host high-quality diamonds. The geological conditions in the region are favorable for diamond formation, given the ancient cratonic rocks that underlie much of the Finnish landscape.

Quality and Variety of Diamonds

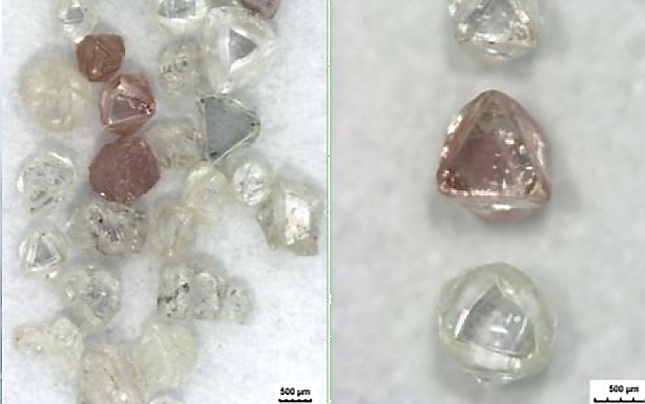

Preliminary assessments and exploration work at Lahtojoki have revealed the presence of high-quality diamonds. These include both colorless diamonds, which are traditionally the most coveted and valuable, and notably, pink diamonds. Pink diamonds are exceptionally rare and command some of the highest prices per carat in the global market, often fetching millions of dollars due to their scarcity and unique beauty.

The discovery of pink diamonds within the Lahtojoki pipe significantly enhances the deposit’s economic attractiveness and potential profitability. The combination of both common high-value colorless diamonds and rare, highly sought-after pink diamonds makes Lahtojoki a uniquely promising asset for Karelian Diamond Resources. This variety could position Finland as a notable player in the niche market for fancy colored diamonds, which often attracts specialized buyers and higher profit margins.

The Road to Mining Rights: Key Approvals

The journey to securing mining rights has been a rigorous process, culminating in a crucial registration by Finnish authorities.

Official Registration by Finnish Authorities

On Thursday, June 12, a pivotal moment occurred when the Finnish Safety and Chemical Agency (Tukes) officially registered Karelian Diamond Resources’ exploration rights. This registration is far more than a mere bureaucratic formality. It legally empowers Karelian Diamond Resources to use minerals extracted from the Lahtojoki deposit. This means the company can now proceed with the extraction of diamonds and other associated minerals, moving beyond just exploratory drilling and sample collection.

The approval signifies that the Finnish government, through its regulatory body, has thoroughly reviewed and approved the company’s plans, including environmental considerations and operational protocols, for commercial mining activities. The strict regulatory environment in Finland means that this approval is based on comprehensive geological data, environmental impact assessments, and a robust operational plan submitted by Karelian.

A Critical Step Forward

Karelian Diamond Resources immediately recognized the magnitude of this regulatory milestone. In an official statement, the company declared, “Confirmation of the registration of mining rights is a critical step for the company.” This confirmation provides the necessary legal and operational foundation for the project to advance. It explicitly means that the company can now confidently plan the next stage of work at the Lahtojoki Diamond Deposit.

This next stage typically involves detailed mine planning, securing financing for full-scale development, procuring necessary heavy machinery, establishing infrastructure, and ultimately, commencing commercial extraction. The clarity provided by this formal approval de-risks the project significantly, making it more attractive for potential investors and partners. Without this registration, any further development would have been speculative and uncertain.

Europe’s First Diamond Mine (Excluding Russia)

A particularly noteworthy aspect of this development, as highlighted by Karelian Diamond Resources, is that the Lahtojoki project is set to become the first diamond mine in Europe, outside of Russia. Russia has historically been a dominant force in global diamond production, with vast resources, particularly in its Siberian regions. The establishment of a diamond mine within the European Union’s borders introduces a new source of supply, potentially reducing reliance on external, non-EU sources.

This could contribute to the EU’s strategic autonomy in raw materials and provide a domestic source of a high-value commodity. It also emphasizes Finland’s commitment to responsible mining practices, as EU regulations often impose stringent environmental and social standards on mining operations, which could serve as a benchmark for other regions. This geographic distinction is a key selling point for the project, both commercially and politically.

Acquisition Details and Financial Structure

The mining concession for Lahtojoki was not developed internally by Karelian Diamond Resources but was acquired from another entity, with specific financial terms outlining the transaction.

Acquiring the Concession

Karelian Diamond Resources confirmed that the diamond mining concession, along with all associated claim reports and additional technical material, was acquired from A&G Mining Oy. This indicates that A&G Mining Oy had previously conducted the initial exploration and perhaps some preliminary assessment work on the Lahtojoki deposit, holding the rights that Karelian subsequently purchased.

This type of acquisition is common in the mining industry, where specialized exploration companies identify and de-risk projects before larger development companies take them on for production. The transfer of comprehensive geological and technical data would have been crucial for Karelian to understand the full potential and challenges of the deposit. This also means Karelian is building upon existing groundwork rather than starting from scratch, which can accelerate the development timeline.

Purchase Price and Payment Structure

The financial details of the acquisition were transparently laid out. The total purchase price for the concession was EUR 150,000. This amount was structured in two parts to manage financial outlay and tie payments to project development:

- An initial purchase price of EUR 50,000 was paid upfront. This immediate payment secured the rights and allowed Karelian to begin its planning and further exploration.

- A further payment of EUR 100,000 is due after 24 months. This deferred payment structure provides flexibility. Critically, Karelian retains the option to decide not to develop the project. If the company determines that the project is not commercially viable after further assessment within this two-year period, it is not obligated to make the second payment. This provision offers Karelian a crucial period for due diligence and risk assessment before committing the full acquisition cost, allowing them to confirm the project’s economic feasibility and resource estimates. This staged payment mechanism is typical in mineral asset acquisitions, balancing upfront commitment with ongoing evaluation.

Royalty Agreement: Long-Term Returns

In addition to the fixed purchase price, a royalty agreement has been established with A&G Mining Oy, ensuring a long-term financial stake for the original concession holder based on the mine’s future production. This royalty is structured as follows:

- A 1% royalty is payable on diamond production up to 2.5 million carats. This initial tier provides A&G Mining Oy with a share of the early production. The royalty can be paid either in diamonds (in-kind) or in cash, offering flexibility based on market conditions and the needs of both parties. The ability to receive royalties in diamonds could be particularly attractive if diamond prices are strong, giving A&G Mining Oy direct exposure to the commodity’s value.

- A 2% royalty is payable on diamond production above 2.5 million carats. This higher royalty rate incentivizes A&G Mining Oy and rewards Karelian Diamond Resources for achieving significant, long-term production. It means that once the mine reaches a substantial production milestone, the original concession holder receives a larger share of the ongoing revenue, reflecting the increased success and scale of the operation. This tiered royalty system is common in the mining industry, aligning the interests of the acquirer and the original asset holder, and ensuring that the original developer benefits from the long-term success of the project they initiated. This financial structure highlights the careful consideration given to the long-term profitability and equitable distribution of returns from the Lahtojoki mine.

Beyond Diamonds: Karelian’s Diverse Portfolio

While the Lahtojoki diamond project is undoubtedly Karelian Diamond Resources’ most high-profile venture, the company is actively engaged in other mineral exploration efforts, showcasing a broader strategic interest in valuable resources.

Exploration in Northern Ireland

In addition to its diamond aspirations in Finland, Karelian Diamond Resources is also diligently exploring for other valuable minerals at its Colebrook site. This site is located in Northern Ireland, indicating the company’s geographical diversification beyond the Nordic region. The focus of exploration at Colebrook includes a suite of critical industrial and precious metals:

- Nickel: A crucial component in stainless steel, batteries (especially for electric vehicles), and various alloys. Demand for nickel is rising rapidly due to the electrification of transport.

- Copper: An essential metal for electrical wiring, construction, and electronics, with growing demand driven by renewable energy infrastructure.

- Platinum-group elements (PGEs): This group includes platinum, palladium, rhodium, ruthenium, iridium, and osmium. PGEs are highly valued for their catalytic properties, making them indispensable in automotive catalytic converters, jewelry, electronics, and various industrial applications. Platinum and palladium, in particular, are extremely valuable and in high demand.

The exploration at Colebrook demonstrates Karelian’s strategy to build a diversified portfolio of mineral assets. By engaging in both diamond and base/precious metal exploration, the company mitigates risk associated with fluctuations in any single commodity market. It also positions itself to capitalize on the increasing global demand for critical raw materials driven by industrial growth and the transition to green technologies. This broader exploration strategy indicates a robust and forward-looking approach to resource development.

The environmental and geological characteristics of Northern Ireland present different exploration challenges and opportunities compared to Finland, showcasing Karelian’s adaptable operational capabilities across diverse geological settings. The prospect of finding significant deposits of these metals further enhances Karelian’s overall asset base and future revenue potential, providing a stable foundation alongside the potentially high-reward diamond project.

Environmental and Societal Context: Responsible Mining in the EU

The approval of a diamond mine in Finland, an EU member state, naturally brings with it scrutiny regarding environmental protection and societal impact, as Europe maintains some of the strictest mining regulations globally.

Adherence to Strict EU Regulations

Finland, like all European Union member states, adheres to extremely stringent environmental regulations and social responsibility standards for mining operations. The Finnish Safety and Chemical Agency’s (Tukes) approval process would have involved comprehensive assessments of the project’s potential environmental impact.

This includes detailed studies on water quality, biodiversity preservation, waste management (tailings), and reclamation plans for the mine site after closure. Karelian Diamond Resources would have had to submit exhaustive reports outlining how they plan to mitigate any negative impacts, ensure sustainable practices, and comply with all national and EU directives.

This rigorous oversight means that the project, if it proceeds to full operation, will be held to a high standard of environmental stewardship. Public consultations and stakeholder engagement are also integral parts of the approval process in Finland, ensuring that local communities have a voice in the development.

Economic Benefits and Local Impact

Beyond the direct extraction of diamonds, the Lahtojoki mine project is expected to bring significant economic benefits to the Kuopio-Kaavi region and to Finland as a whole. Mining operations create direct employment opportunities, both during the construction phase and for ongoing operations.

This includes jobs for geologists, engineers, machinery operators, administrative staff, and support services. Indirectly, the mine will stimulate local economies through demand for goods and services from local suppliers, boosting small businesses and fostering regional development. Tax revenues generated from mining activities will contribute to local and national government coffers, which can then be reinvested in public services, infrastructure, and education.

While the potential for environmental impact is always a concern, the economic uplift in remote regions can be transformative, providing stable, well-paying jobs and stimulating ancillary industries. The long-term economic viability of the mine, supported by the quality of the diamonds found, offers a sustainable source of local prosperity, balancing industrial development with responsible environmental practices in a transparent and regulated framework.

The successful and responsible operation of Lahtojoki could serve as a model for future mineral extraction projects within the European Union, demonstrating that resource development can be pursued in alignment with high environmental and social standards.